ESG (ESG) is an acronym in English, which stands for "Environmental, Social, and Governance." In Portuguese, it is known as ASG, "Ambiental, Social e Governança." The concept corresponds to corporate actions related to environmental, social, and governance practices.

The Origin and Meaning of ESG

The term originated in 2004 when former United Nations website Secretary-General Kofi Annan challenged 50 CEOs of major financial institutions worldwide to integrate these three pillars into the capital markets by 2030.

Impact of ESG on the Financial Market

The acronym became well-known, and the financial market started to demand it. Companies began to understand that their goal cannot be solely to generate profit for their shareholders but also to consider that good ESG practices create shared value for their stakeholders. Consequently, this ensures the company's longevity, increases stakeholder trust, reduces risks, including reputational ones, lowers the cost of capital, and improves stock performance.

ESG is tied to purpose. A purpose to do better, a purpose to focus more on the environment, a purpose to view employees in a humane and empathetic way, a purpose to consider customers, suppliers, investors, and all stakeholders; a purpose to have robust corporate governance with a REAL and GENUINE perspective to make good decisions, including sustainability in the company's strategy.

Relevant Topics for Each ESG Pillar

For example, let's look at some relevant topics for each ESG pillar:

- Environmental: Climate Change – reduction of greenhouse gas emissions; Protection of natural resources; Sustainable waste management; Efficient management of raw materials, etc.

- Social: Respect for human rights; Healthy working conditions; Employee well-being; Health and safety care; Combating practices analogous to slavery and child labor, etc.

- Governance: Diversity and inclusion on the Board of Directors; Ensuring the independence of the Board of Directors; Transparency; Combating corruption; Risk management, etc.

Additionally, it is worth mentioning that ESG is connected to the Sustainable Development Goals (SDGs), as the 17 SDGs (Sustainable Development Goals) bring goals, indicators, and challenges related to these three important ESG pillars, providing a significant opportunity for companies to incorporate them into their strategy for a more sustainable business.

Now, speaking a bit about Corporate Sustainability, the term originated from sustainable development, established by the World Commission on Environment and Development in 1987, in a report "Our Common Future" an initiative of the United Nations.

“Sustainable Development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” (Brundtland Report, Our Common Future, p. 24)

Thus, we know that companies are responsible for the impacts their business causes, both environmentally, socially, and in terms of governance. Sustainability has been discussed for several decades as a way to create an agenda for organizations to align their actions with this theme, making it a segment of every business.

ESG and Corporate Sustainability: An Interdependent Relationship

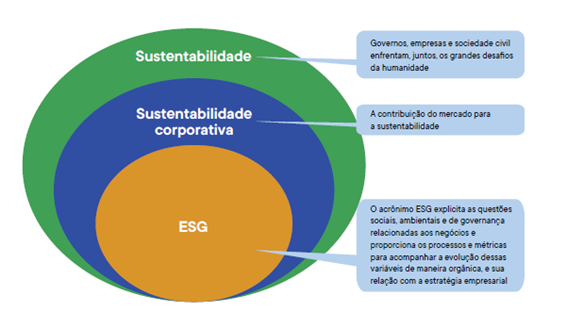

Therefore, we conclude that ESG and Sustainability are interchangeable terms. ESG establishes a perspective beyond financial profit, connecting not only environmental practices but a set of correlated practices with a view toward the social pillar and corporate governance. This can foster sustainable development and enable the company to manage risks and pressures.

According to the United Nations (UN), Corporate Sustainability means the strategic and intelligent use of natural resources to ensure the autonomy of future generations. This involves adopting strategies that a company employs to seek profit while considering the planet's natural resources and the social impact its actions can have on the community.

We conclude that the theme of sustainability has always existed, but with the advent of the term ESG, it has gained even more momentum. This approach is increasingly being discussed in relation to business strategy, becoming a crucial topic in national and international forums and debates. This is fundamental for the longevity of companies in the market in which they operate.